Daniel Ek, Supply chains, Stripe in 2011, Seeing your life as a call option

“Your Life is (Almost) a Call Option” by Byrne Hobart

Markets are laboratories for the study of human behaviour, and as such they provide a great arsenal of vocabulary for explaining the non-financial world. If you don’t make a living as a derivatives trader, believing that volatility is a positive force might be counterintuitive. From birth, volatility in asset or commodity prices is presented as cause for concern. This is sensible at a societal level: uncertainty is not a stable base to build common prosperity. But since Keynes, economists have recognised that applying societal standards at an individual level and visa versa, might not be applicable. Understanding how volatility can be a useful force at the individual level is a necessary component of nonlinear thinking.

Take an example of a call option with an expiration one year from now and a strike price of $10. If the stock the option references is at $5, and its annualized volatility is 50%, the option is worth about 13 cents. In other words, the option buyer is making a bet on a fairly remote outcome. If the price goes up, the option is, naturally, worth more. It’s also worth more in response to volatility. And, the further away from the exercise price it is, the more volatility dominates: imagine the stock trades at $2.50, or half the previously assumed price, but the annualized volatility doubles to 100%. The value of the option rises in that scenario, to 17 cents.1

There are many situations in life that map to this out-of-the-money option math. Consider anything in your life that 1) you’d like to have, 2) that you probably won’t get, but 3) that it’s not logically impossible for you to get—and whose outcome you can in some sense control. Most of the pathological examples are pretty bad risk-adjusted bets: winning the lottery, becoming a world-famous TikTok personality, winning a national election, etc. But there are some more realistic options—long-shot jobs and career changes, side projects that could become more-than-full-time projects, and decisions in your personal life.

It’s important to note upfront that this mapping is imperfect. The reason stock options give us such clean, formulaic theories is that financial contracts strip away everything qualitative. The market only works if shares and dollars are perfectly fungible with one another.2 That said, the options approach does give some directional guidance; it doesn’t tell you the answers, but it might tell you where to look—and, what’s particularly valuable in general frameworks for how to live your life, it’s especially useful for dealing with adversity.3

It’s common preparation for a job interview to run through hypothetical scenarios the interviewer might throw at you. “Why do you want to work at X?” and “How do you explain this 4-year career gap?” (extra points if you answer without using the phrase “misspent youth”). But a scenario you probably haven’t war-gamed: what do you do when you get knocked off your motorcycle on the way to the interview? If you’re Bob Chapman, and on the way to a Salomon Brothers interview, you keep going. He showed up covered in blood, and got the job.

The situation perfectly illustrates the dynamics of volatility. After the accident, your odds of getting the job are pretty low. If you show up to the interview and crash-and-burn (so to speak), you’ve got an easy excuse. On the other hand, you’re bound to stand out amongst the pool of applicants and nobody will question your commitment, so you might as well give it a try. In option terms, Chapman’s current price went way down—the visibly bleeding interviewee has worse odds than the one who shows up looking sharp. But the variance went way up! His interview was definitely going to be the most memorable one for that role, so all he really had to solve for was a) appearing generally qualified, and b) convincing his interviewer that the motorcycle-riding and accident demonstrated the right kind of risk tolerance.

It applies to corporate strategy, too, especially for desperate companies. The founders of Ozy also thought they might as well pursue a high-variance/low-expected value strategy. The digital media startup was trying to raise $40 million from Goldman Sachs’ asset management division. As Money Stuff covered this week, the founders of the digital media startup impersonated a YouTube executive to deceive Goldman’s due diligence before the investment. Clearly, the founders felt they were out-of-the-money if they didn’t take action and to their mind, the downside of being discovered was having to fundraise elsewhere. On the flip side, they would receive their funding and Goldman would be incentivized not to disclose that Ozy had tricked them. By anyone’s determination, this strategy increased volatility.

However, Ozy hadn’t factored in Goldman going to the press, once they discovered their conversation with Samir Rao, Ozy co-founder, was not with Alex Piper, Head of Programming for YouTube Originals. This is a great illustration of why purely option-driven thinking is a guideline but not an absolute. As it turns out, Ozy did not have a pure out-of-the-money option, with no downside from increasing volatility. Instead, they had serious downside risk, which continues to play out.

The optionality approach is morally neutral itself, but often recommends morally dubious behavior. Committing crimes or engaging in deceptive behavior generally is certainly a way to raise the variance in your outcomes! But it might make sense to treat this as a backwards-looking explanation rather than strict guidance: the reason we should find it unsurprising that some companies commit blatant deceptions, like faking a meeting with an executive, is that they have little to lose. (In this case, the little-to-lose may come from earlier deceptions; Ozy has cited a 25 million member newsletter, but its public presence doesn’t really match this. For example, the company’s Twitter feed allegedly has 45,000 followers, and its most recent tweet has, in the seven hours it’s been up, gotten zero likes, zero retweets, and one response—about the scandal, not the story the Twitter account shared.)

It’s possible to imagine an Ozy model where exaggerated engagement got them funding, and that funding allowed them to pay for content that would then produce engagement numbers in line with what they’d originally promised. There are many strategies for building a big media and influential media company, and one approach is to act as if it’s already built and use that impression to raise the funds and attract the talent necessary to make that come true. (If we think of media companies as being in the business of shaping public perception, you should be suspicious of any media company that doesn’t give the world an exaggerated sense of that company’s own importance. Are they really good at their jobs!?)

But it raises another important point about optionality: historically, people who blindly buy stock options lose money over time. Verdad Research has a wonderful new post about this, with a pretty damning chart that goes almost straight down with only the occasional jump during times of market chaos.

Normally, producing gains of around 13% during a financial collapse would make you feel very smart indeed, but for the blind put option buyer, it’s quite depressing; it’s a reminder that when their strategy really pays off, that means going from down 40% to down 32% since inception.

But that’s a result of a market where there’s a wide range of assets quoted, and there’s always someone on the other side of the trade. If you’re given a set of options with market prices, and you insist on constantly buying those options, you’ll tend to underperform over time. But in the real world, the option-like situations you’re presented with are somewhat random; it’s not an opportunity available to everyone in the world with a brokerage account, but an opportunity available to a more select group of people. And the pricing and payoff of those option-like opportunities isn’t subject to the market’s imperfect but relentless pursuit of maximum efficiency.

There’s another side to the options trading dynamic, and it also has some explanatory power: in high-prestige, highly-tracked careers—Biglaw, Big Three Consulting, increasingly Big Tech—the winners are a) generally people who are well-qualified for what they got, but also b) people who lucked out in a process that has an element of randomness. It’s intuitive that if a group of people are being assessed in roughly the same way, stack-ranked, and then allowed to advance only if they hit a certain cutoff, there will be some mix of luck and skill in the outcomes. But what’s perhaps less obvious is that the more people who are competing, and the more fine-grained the assessment is, the more the outcome depends on luck versus skill. Trying to figure out if someone is 95th percentile or 50th percentile is doable in many domains, but if you’re trying to select for 99.5th percentile, what you’re effectively doing is picking out people who were near the top and also happened to be lucky in some way.4

This tends to make the winners of such a contest risk-averse; within their cohort, they see that past success is partly random, so they know that future variance is more likely to make them worse-off than better-off. And since the people who succeed in these careers have substantial real-world influence, that means there’s a growing tendency to bet against volatility rather than betting on it.

Which adds yet another way that the market metaphor is imperfect but action-guiding: stock options are expensive because the number of people who think something exciting will happen imminently is higher than the number of people who wake up ready to explicitly bet that the future will be boring. But in careers, the opposite dynamic may hold: there are many career paths that encourage winners to bet against volatility, which means there are lots of opportunities to take the other side of the trade.

Source: "The Diff" by Byrne Hobart and Jack Wiseman

Recommended podcast listen:

Listen to Spotify founder Daniel Ek in this great podcast with Patrick O’Shaughnessy where he discusses the European startup ecosystem, the worlds of “bits vs atoms” and his personal investments.

Most interesting tweets of the week:

#1 If you want to look deeper into the causes of the recent shortages - this is the reading you were looking for!

2# Patrick Collison (co-founder of $100 billion Stripe) moving the startup’s hardware by bike in 2011!

# 3 Warren Buffett describing the influences that shaped his investment style: 85% Fisher/15% Graham.

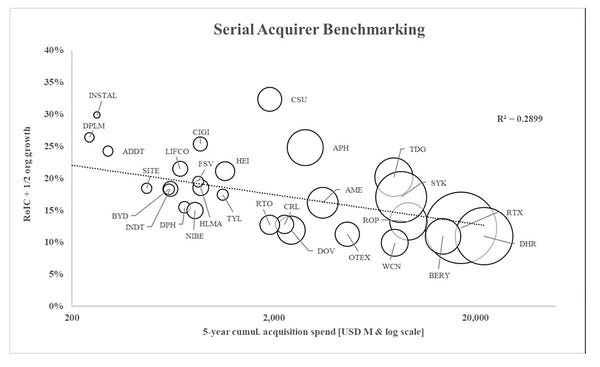

#4 There’s an inverse correlation between the size (and frequency) of companies’ acquisitions and their efficacy. Constellation Software is a clear exception!

If this was forwarded to you - you can subscribe by clicking here.

Once per week, we send our subscribers the most interesting finance, economics and business-related content we come across on the internet!